Clearing

The clearing and settling of bullion transactions in London takes place across an electronic clearing system.

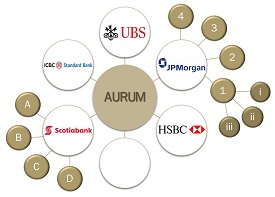

The clearing system is operated by the London Precious Metal Clearing Limited (LPMCL) which is owned and managed by the five banks: HSBC, ICBC Standard Bank, JPMorgan, Scotiabank and UBS. They utilise the unallocated gold and silver, in accounts they maintain between each other, not only for settlement of mutual trades but also for trades on behalf of their third party counterparties worldwide for whom they provide clearing facilities.

All transactions are settled through ‘AURUM’, an electronic clearing system operated by the LPMCL. Each client provides a list of bullion settlements, resulting from transactions with their own group of counterparties, for the next business day. These instructions - to receive or deliver bullion - will be forwarded to their London bullion clearing member, usually via an internet system, telex, fax or Swift message. In many cases, each settlement will be the ‘net’ of several purchases and sales with their counterparties. Netting of same-day value trades by counterparty is advocated by the bullion market, as it not only reduces the number of settlements but, more importantly, it reduces the amount of credit risk while the trades are live and at the actual point of settlement.

The diagram to the right illustrates how trades are settled and cleared between the clearing members. In this example, customers of JP Morgan are represented by 1,2,3 and 4, and the sub-clients of customer 1 by (i), (ii) and (iii). All of these transactions are netted at the end of the day through JP Morgan's account. The other four clearers will also settle their customers and sub-clients through their own accounts in a similar way.

Netting is particularly important given that the vast majority of bullion trades are against US dollars. Although the metal leg is settled in London by 16:00, the party due to receive the dollar counter-value in New York will typically not know if the dollars have been received in their account until the US dollar clearing closes at the end of the New York business day. For most European entities, this means they are unable to confirm receipt of US dollars until the following business day.

The London bullion clearing members role involves a considerable degree of direct client contact, electronic interfaces between the clearing members and close liaison with the Bank of England and the many overseas bullion depositories. It is probably simplest to view the settlement of gold and silver bullion transactions, in the same way as a foreign exchange trade would be settled. For example, if you make a spot purchase of US Dollars with Pounds Sterling through your local High Street Bank, on the second business day following the trade date, the High Street Bank will settle the transaction by debiting your checking account with Pounds Sterling, and crediting the counter-value of US Dollars to your US Dollar Bank account (usually in the USA).

In a trade purchase or sale of bullion, the counter-value will require a sale or purchase of currency, with the US Dollar being the most frequently used currency and representing at least 95% of the market for Loco London trading. On the value date the currency leg of a bullion trade will be settled over a currency nostro account (usually US Dollars through a New York -based Bank) while the gold or silver leg of the trade, will usually be settled through one of the five London bullion clearing members.

On average in excess of 20 million ounces of gold is cleared daily in the London market and in excess of 200 million ounces of silver. The MCBIH publishes the clearing statistics on a monthly basis ,the monthly clearing statistics can be found here.. The LPMCL incorporate well-established MCBIH practices and market understandings, under a framework covering two main areas:

- The right each shareholder of the LPMCL has over any other shareholder of LPMCL to call on his unallocated account with the other member.

- The timing under which instruction for transfers and allocations may be given and effected. Transfer instructions for members’ own purposes and for client transfers can be made up to 16:00, London time, on the day of settlement. Clearing members then have until 16:30 to enact transfers or call for allocation for credit purposes.

OTC Cleared (use of central counterparty)

Traditionally, Gold forwards have existed between two parties with bilateral credit arrangements. Whilst this method has been used for many years, and makes up the majority of all forward trades, an alternative exists. This is when members of a common ‘Central Counterparty’(CCP), that has a facility to clear forwards, may novate their trades and thus avoid bilateral credit risk. In the absence of an exchange, the trade remains one of an OTC nature but has the ability to be cleared.

This method of credit mitigation is known as OTC Cleared. The parties agree the parameters of the trade and then pass the trade to the CCP. The CCP then becomes the principal to the trade and margins and re-margins the open positions between its members using a published daily curve, which can be referred to as ‘settlement prices’.

Bullion accounts

Transactions settled through the clearing system involve the settlement of gold across the accounts of the transaction counterparties. This is usually done by effecting ‘paper transfer’s between the respective accounts (to avoid the issues associated with the physical movement of bullion). There are two main types of bullion account, unallocated and allocated accounts.

Unallocated Accounts

Most traded and settled bullion in London is on an unallocated account basis. This is an account where the customer does not own specific bars, but has a general entitlement to an amount of metal. This is similar to the way that a bank account operates: in that a customer may not necessarily back receive the same notes they originally deposited. Similarly, a customer with an unallocated account who physically withdraws their metal will not necessarily receive the same gold bars back they deposited. It is the most convenient, cheapest and most commonly used method of holding metal.

The units of these accounts are one fine ounce of gold and one ounce of silver, based upon a 995 LGD gold bar and a 999 fine LGD silver bar respectively. Transactions may be settled by credits or debits to the account, with the balance representing the indebtedness between the two parties. Credit balances on the account do not entitle the creditor to specific bars of gold or silver. Instead the balance is backed by the bullion stock of the dealer with whom the account is held. The client is an unsecured creditor.

If a client wants to have actual metal, specific bars or equivalent bullion product are ‘allocated’, the fine gold content of which is then debited from the unallocated account. The market convention is that bullion may be allocated on the day it is called for, with physical metal generally available for collection on the next business day.

Allocated Accounts

These accounts are opened when a customer requires title or ownership of specific bars. The client has full title to the metal in the account, with the dealer holding it on the client’s behalf. Clients’ holdings are identified in a weight list of bars, showing the unique bar number, gross weight, the assay or fineness of each bar and its fine weight. Credits or debits to the holding are linked to the physical movements of bars, to or from the client’s physical holding.